Essential Homebuyer Contingencies & Inspections

Offer accepted? Congratulations! Now the real work begins.

A good buyer’s agent will assist you – and sometimes push you – to order a variety of professional inspections of the property you plan to buy. Far from just peace of mind, inspections give buyers fair warning about potentially costly unknown property defects and leverage to do something about it before the transaction closes.

In my experience, inspections pay for themselves many times over. Licensed inspection reports are a tool for me to negotiate repair credits during the escrow’s contingency period, when the balance of power tends to shift from seller to buyer.

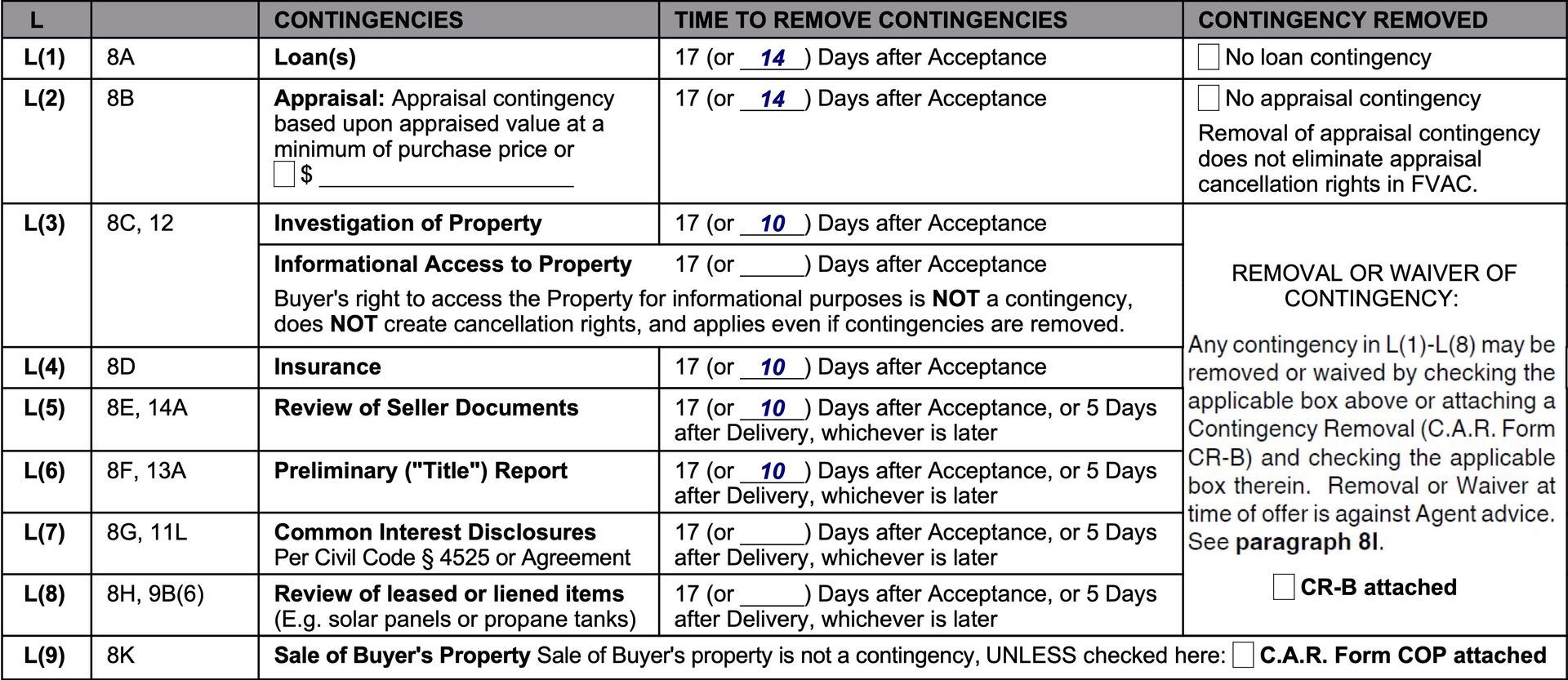

But first, contingencies. Contingencies allow buyers to exercise their right to leave a transaction without sacrificing their earnest money deposit.

Inspections are part of the buyer’s

Investigation of Property contingency, which includes all tangible aspects of the home and other external factors impacting the home (noisy neighbors, school attendance boundaries, etc.).

Loan and

Appraisal contingencies protect the buyer if the lender denies their loan or the home does not appraise for the purchase price, in which case a price reduction or higher down payment would be required for loan approval. New in 2024 due to volatility in the industry, the

Insurance contingency allows buyers to confirm both the availability and cost of homeowners insurance.

Review of Seller Documents gives buyers time to review

legally mandated seller disclosures, and

Preliminary Title Report

discloses liens, restrictions, easements or other determinantsagainst the property.

Common Interest Disclosures report the financial health and rules governing any HOAs, and

Review of Leased or Liened Items discloses obligations that run with the property, including any solar power payment obligations.

Back to

Investigation of Property, there are usually two rounds of physical inspections – an initial look to identify potential issues, and specialty inspections that explore specific defects and suggest costs of repair.

Each inspection might cost $100 to $350 or more, depending on the size of the property – as your agent I can provide referrals and help you price compare.

EXPLORATORY INSPECTIONS

General Inspection: A licensed and insured general inspector produces a lengthy overview detailing observations about all aspects of the home, from large core components such as the home’s foundation down to whether each burner on a gas range is working properly. The general inspection report flags issues for further investigation by subject matter experts who will also estimate costs of repair.

Moisture & Mold: Identifying possible sources of past or present moisture intrusion and any evidence of mold is essential to protecting your health and finances, as mold remediation tends to be pricey. If needed, consult a

Mold Remediation Specialist during your contingency period for a cost estimate.

Termite: If a termite clearance report is not provided by an HOA or a seller, check for wood-destroying pests and related damage before releasing contingencies.

Sewer Line: Running a camera from your home to the main line in the street can uncover costly unknown damage, allowing the buyer’s agent to negotiate for repair credits if work is needed.

SPECIALTY INSPECTIONS

Chimney: It’s rare to find a chimney in Los Angeles that doesn’t have something wrong with it, often due to seismic activity. Be realistic in your expectations, but be highly vigilant about fire safety issues.

Roof: Roof certifications may be needed for home insurance purposes. In other cases, it may be sufficient to have a roofer physically inspect for damage and produce an estimate.

HVAC & Electrical: A general inspector will call out possible issues, but it’s always a good idea to have a specialist inspect your heating, air conditioning and electrical systems. It is extremely common to find outdated and

potentially dangerous electrical panels in older homes and condominiums throughout Greater Los Angeles, as well as central air systems in need of repair. In my personal experience, HVAC and Electrical inspections almost always result in a repair credit.

Plumbing: A general inspector will call out any plumbing concerns, and if there are issues a plumber can address them more in detail and price out repairs.

Foundations/Drainage/Geology: During one recent sale in West Los Angeles, a tip from our general inspector prompted a follow-up foundation inspection that discovered moisture issues underneath a home. Geologists typically aren’t needed for flat land, but recommended for all hillside or heavily sloped properties.

Pool & Pool Equipment: Older pools and pool equipment can be expensive to repair.

As your agent, reports by licensed and insured home inspectors help me protect your health and financial interests. During the contingency period, I can use these reports to negotiate for sellers to help fund repairs of any previously unknown defects.

Unless a buyer expects to replace all major appliances within the first year, I can also push for the seller to fund a one-year

home warranty policy to cover everything from home appliances to central air and heat to the water heater and any pool equipment.

Call me at

(310) 733-0931 for a step-by-step consultation of everything that goes into the homebuying process.

Joe Piasecki

Jasan Sherman Real Estate Collective

Coldwell Banker Realty

DRE 02158933