Top 5 Most Frequent Negotiation Tactics in Los Angeles Real Estate

How the buyer’s agent initiates an offer with the listing agent can make or break a deal.

Before writing an offer, buyers need to find out as much as they can about the seller’s motivations and what’s most important to them.

For most sellers, it comes down to price. But not always!

The extent and duration of buyer contingencies, who pays what fees, flexibility about time of possession, and even the length of the escrow period go hand-in-hand with total purchase price to shape the bigger picture of the deal.

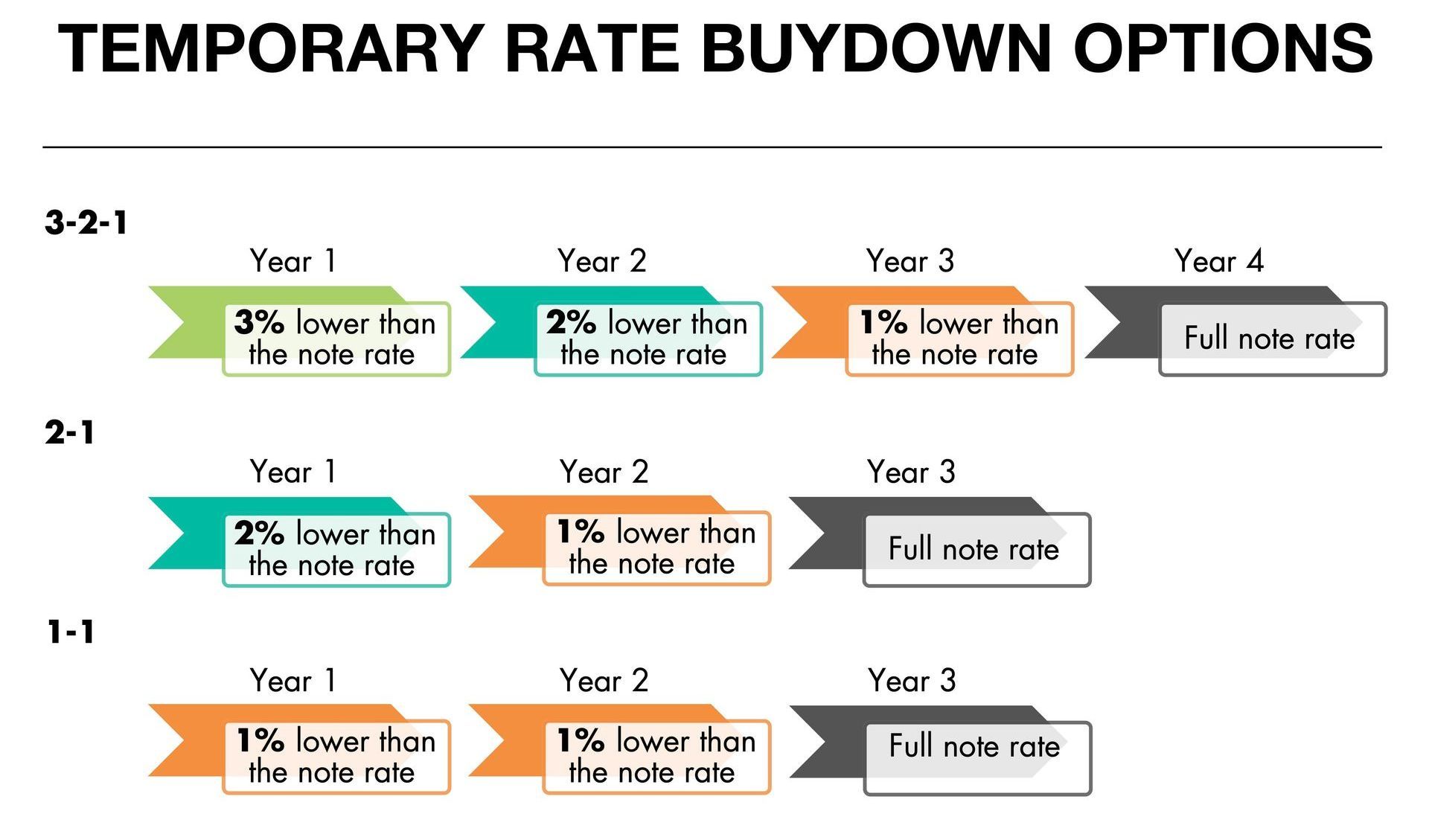

Buyers may also negotiate upfront cash credits for closing costs or to buy down the initial interest rate of the mortgage – instead of a price cut, asking the seller to make monthly payments more affordable, which I have found tends to be more persuasive.

Once an offer is accepted, repair credits for previously unknown defects usually come into play between buyer inspections and the removal of investigation contingencies.

In my experience, these are 5 of the most frequently negotiation points for homebuyers in the Greater Los Angeles Real Estate Market:

1. Contingencies

If there’s anything sellers prioritize as much as money, it’s having as much certainty as possible that the buyer is willing and able to close the deal. The attractiveness of cash offers isn’t that buyer money is any better than a bank’s money, it’s the removal of buyer loan and appraisal contingencies that could blow up a deal. In competitive situations, buyers can make a lower offer more attractive by tightening contingency periods down to no more than what’s necessary. The buyer’s agent should pre-schedule inspections to get a jump start on the calendar, and work lockstep with an expert mortgage broker who can cut through underwriters’ red tape. The tightest loan-involved escrow I’ve accomplished was for a $2.7 million purchase with a $2 million loan in just 16 days.

2. Time of Possession

Back in 2022, my clients came in second place out of three offers for their dream home on a quiet cul-de-sac in the heart of Mar Vista. But we were the only buyers willing to accept a delayed move-in date to accommodate the seller’s needs, which was important enough to the sellers that they accepted our offer that was tens of thousands of dollars under the top position. An effective buyer’s agent will work to discover the priorities and motivations of the seller, which could include additional move-out time, delaying close of escrow to accommodate a tax-deferred 1031 exchange, or even to push the sale into the next tax year.

3. Cash Back at Close

Buyers who need help with closing costs or want to reduce their initial monthly loan payments can negotiate cash back at close from the seller. In addition to improving affordability for the buyer, these seller credits reframe a deal around collaboration to meet what a buyer can realistically achieve instead of a more conflict-driven battle over a purchase price. First-time buyers I represented in Pico-Roberson succeeded with a below-ask offer on a cosmetic fixer because we refocused the conversation from purchase price to monthly payment. By using seller credits to buy down the initial interest rate for the first two years of the mortgage, we brought the seller’s price expectations back to reality and the buyers’ monthly expenses to a lower amount than they had when they were renting!

4. Who Pays for What

Conventions of Southern California real estate are that the seller typically pays for most costs of sale except buyer escrow and lender fees, but that doesn’t always have to be the case. With the restructuring of agent commissions, allocation of costs in residential real estate is getting more attention. Even before these changes, small tweaks to allocation of costs such as HOA assessments and move-in fees can have a positive impact on negotiations, especially in a multiple counter-offer situation.

5. Repair Credits

Negotiations often continue during escrow after a deal is reached. When buyer inspections uncover previously unknown property defects, buyers have leverage during their contingency period to ask for help with repairs – usually in the form of a reduced purchase price or cash back from the seller at close of escrow. Fairness should be the guiding principle, and an experienced agent will know what to ask for and how to ask for it – or, when representing sellers, whether to accept or deny requests based on listing history and current market conditions. In my experience, older homes in pretty good shape will still typically involve a conversation about seller credits related to electrical and HVAC system inspections, unless a seller gets ahead of the issue with appropriate disclosures.

Call me at

(310) 733-0931 to discuss your personal situation in the context of current market trends.

Joe Piasecki

Jasan Sherman Real Estate Collective

Coldwell Banker Realty

DRE 02158933